VestServe IMS

Investment Management System

The VestServe Investment Management System (IMS) offers a great diversity of functionality. Our accounting and deployment team helps customers account for some of the most complicated operations and structures. Users can leverage IMS’s deep accounting capabilities to easily, accurately, and effectively streamline operations – such that separate integrated systems is less necessary.

VestServe offers daily accounting for all valuations and flows for almost any marketable security; all equities, fixed income instruments, options, and futures, and more. And users can fully account for and manage, almost any ownership structure; separate accounts, master-sub accounts structures, funds, funds of funds, and structures many levels deep. Reporting is very customizable and so strong that it can even detail positions and activity owned indirectly, in the proportion owned. Portfolio Management includes many various risk analyses and including performance measurement, analytical, and reporting/query functionality. Many of our customers bring many separate operations onto one platform.

Automated nightly integrations help you maintain accuracy by emailing reconciliation reports that detail the results. We provide our customers with tight automated integrations with custodians and data sources. We will also provide customer statements with report distribution systems and web reporting.

The VestServe solution helps you company:

Reduce Costs & Risks

Aggregate your data and access it with customizable very extensible reports. Reduce costs, simplify maintenance while improving reliability, accuracy, and quality.

Improve Operating Efficiencies

Automate integrations and maintenance tasks. Together we will strive to relive burdens from the back office, provide increased capabilities to the middle office, and enable the front office to pursue new and more diverse opportunities.

Increase Accuracy and Reliability

Leverage real-time accounting, reconciliation, validation, audit, and security controls to improve the reliability and accuracy of your operations.

Improve Customer Service

Respond quickly to customer requests for information using integrated report writer, presentation reports, report publishing system, and or out web reporting portal.

Instruments and Instustries

Designed To Account for All Negotiable Instruments

IMS is designed to accurately account for virtually any negotiable instrument or asset sector.

- Report on all history (activity, flows, and valuations)

- See into the future via IMS’s projected cash flows and valuations reporting

- Set up automatic participant level reinvestment or distribution rules

- No longer allocate investment activity based on periodic proportional ownership, have IMS dynamically do this for you (with daily accuracy)

- Track all income and gains (recognized and unrecognized) for any period

- Manage rights to restrict user access to certain functionality (ex: change history, alter instruments)

- Restrict users from access certain portfolios and holdings

- Track changes (new, deleted, or altered) via the auditing and logging system on any major element such as transactions, instruments, and portfolios

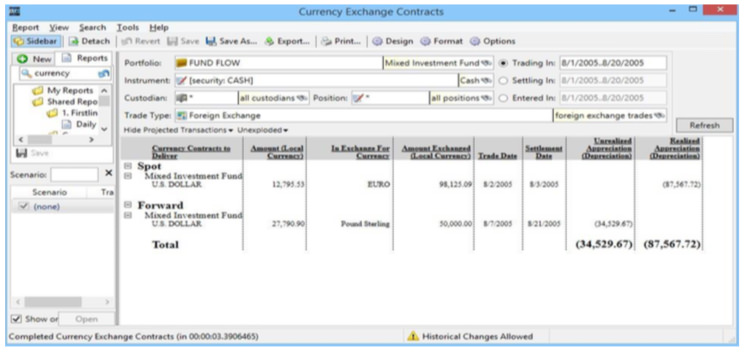

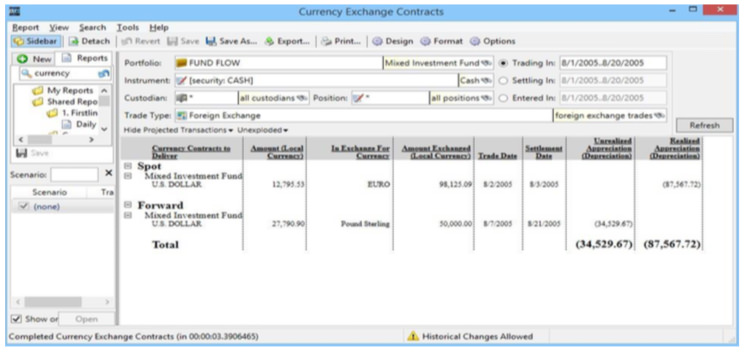

- You need not maintain a specific base currency, track conversions to any base currency

- Performance gains/losses and analytics can be reported in either currency

- Track values in multiple currencies at the same time (single report)

- Have foreign dividends pay directly in a base currency

- Automatically calculate and project fees using tiered structures

- Aggregate assets to calculate fees and then allocated the resulting fees to accounts

- Supports required fee structures at every level – administrative fees, investment management fees and high watermark fees

Accounting

Keep Track Of All Accounting Details

IMS allows you to account for all transaction details and more.

- Report on all history (activity, flows, and valuations)

- See into the future via IMS’s projected cash flows and valuations reporting

- Set up automatic participant level reinvestment or distribution rules

- No longer allocate investment activity based on periodic proportional ownership, have IMS dynamically do this for you (with daily accuracy)

- Track all income and gains (recognized and unrecognized) for any period

- Manage rights to restrict user access to certain functionality (ex: change history, alter instruments)

- Restrict users from access certain portfolios and holdings

- Track changes (new, deleted, or altered) via the auditing and logging system on any major element such as transactions, instruments, and portfolios

- You need not maintain a specific base currency, track conversions to any base currency

- Performance gains/losses and analytics can be reported in either currency

- Track values in multiple currencies at the same time (single report)

- Have foreign dividends pay directly in a base currency

- Automatically calculate and project fees using tiered structures

- Aggregate assets to calculate fees and then allocated the resulting fees to accounts

- Supports required fee structures at every level – administrative fees, investment management fees and high watermark fees

Trade Order Processing

Process Trade Orders of Multiple Types

- Issue trade settlement and track status through SWIFT and FIX messaging capabilities

- Require Trade approval by restricting unauthorized users to save non-compliant trades to a staging area for management approval

- Allocate block trades across various portfolios various means: by percentages, share counts, or other methods as easily as you would a standard trade with a single owner

- Produce customizable trade tickets for back office processing

Portfolio Management

Robust Performance Measurement and Analytics

GIPS compliance – IMS can help you maintain full GIPS compliance. Many return analytics are available, including Time Weighted (Modified Dietz) Rate of Return, IRR (Internal Rate of Return) plus others. The returns formula engine is very ‘enabling’ and provides real time (requires running a report, typically less than 30 seconds of processing).

Performance measurement tools that support reporting and decision making include:

- Price sensitivity, yield, and return measures

- Performance and analytics reported over any period or periodicity

- Asset allocations and contribution returns broken out by currency, sector, sub-sector, asset type, portfolios or any desired group

- Calculate returns either net or gross of fees, with or without receivables and payables, and with or without cash

- Complete portfolio allocation/contribution and attribution reporting

- Report Time Series Analytics such as Sharpe, standard deviation, beta, delta, yield, duration, convexity, and R- squared (for evaluating investments and measuring unsystematic and systematic risk)

- Scenario analysis performs “what if” scenarios during rebalancing or when performing a single trade to view how the impending action will affect a portfolio’s performance

- View multiple trade scenarios side-by-side concurrently

- Perform accurate cash flow projection using interest reset projections and reinvestment analysis

- Post portfolio Modelling rebalancing’s and allocated block trades to Scenarios

- Present Value (Yield Curve) Analysis - Analyze a position and/or portfolio in relation to a yield curve

- Maintain various yield curves and derive new yield curves for valuation analysis

- Discount projected cash flows at the appropriate rates from a yield curve

- Users can perform spread and valuation analysis maintain many yield curves by only specifying the spreads (parallel or non-parallel) from an original yield curve

- Multi-Valuation – maintain multiple valuations and prices at the same time

- Assess the impact of a non-parallel yield curve shift on the present value of your individual cash flows

Modeling and Compliance

Real Time Portfolio Rebalancing

Users can use a variety of rules to generate Portfolio Models (by sector, instrument type, even particular instruments). When portfolios stray from their defined Model Portfolio, the system can project rebalancing trades.

You can have IMS suggest rebalancing trades (or you can allocate block trades) within compliance restrictions. This ensures that company and portfolio guidelines are maintained constantly.

- Ensure compliance with prescribed mandates, pre or post-trade

- Use model to operate within a manager’s specific guidelines

- IMS will suggest trades, based on pre-established guidelines, to help you bring the portfolio back into line

- Post-trade compliance reporting is also provided

- Compliance Manager alerts users when a portfolio is no longer within the pre-established guidelines (i.e. CMO and ABS instruments must be rated AA or better, or amortized cost positions with a particular issuer can’t be greater than 10% of the overall portfolio).

- Internal company policies dictate “how we do business”. Warnings are generated and a report is provided when a rule is violated.

- Tracks restricted assets

- As a regulatory tool, preset rules are defined. IMS will issue a warning when an impending trade violates relevant regulations. As the planned trades are adjusted, the violation window updates in real time. You can also report regulatory violations on history.

- Compliance Manager offers robust risk management at either the pre or post trade compliance level

- IMS is able to highlight which rule failed, if the failure is new and when the failure started. IMS can even suggest possible solutions based upon your rules

Intelligent Reporting

Smarter Queries & Reporting Capabilities

IMS is delivered with a complete set of standard reports which can be scheduled to print on queue as required. But the real flexibility of the reporting engine is in its ability to immediately turn any screened query into an“ad hoc” report, which can then be modified to meet your exact needs.

- Report on any time frame, either future or historic (because IMS maintains a complete history and projects future activity)

- Users can easily (“ad hoc”) design queries and quickly turn them into reports

- Add fields using IMS’ unique Design Tool, define groups and subtotals and create your own formulas and filters to create complex reports that can graphed

- Drill down from any report record to those major data elements (trades, Instrument Portfolio, etc.)

- Export any report to Excel, Word, PDF, XPS, Fax, or Crystal Reports, or mail-merge

- Automatically Email, Fax, Post to FTP, or Print Reports in bulk (on job to all parties - controllable)

- Configurable on a portfolio contact basis

- Schedule them to report daily, weekly, or monthly

- Customized hosted web reports

- Easily create and publish customer reports in a variety of formats (pdf, xls, txt, etc)

- Password protected access encrypted via SSL

- Intuitive file management system with hosted data storage

- Share non-IMS report information such as prospectuses, company news and the like

Data Management

Take Control Of Your Data for Better Decision & Better Customer Experience

Many companies suffer from fractured data management or integration needs. When data is stored in various limited systems there emerges a problem in aggregating and ensuring accurate consistent output.

At VestServe we seek to automate our customers operations to enable the business to better focus on their services and customers than their operations. We also enable operations to leverage a holistic platform, avoiding the problems presented by fractured data management.

- Provides a complete set of import and export tools to transfer almost any data item

- Automatically download, import, reconcile and email results. Or automatically assemble and publish reports

- Import all pertinent information and then perform tight accounting reconciliations for a complete Security Master

- Perform multi-party (ex. custodial) integration Validation procedures ensure that imported data is consistent and complete

- Support for SWIFT and FIX messaging as well as limited trade order management

- Manage relationships with customers and leverage our report distribution and web-reporting hosted services

- Hosted customers often benefit from file sharing, tighter integrations, and more custom automations

- View and report on complete historical information and accounting for any time frame

- Hosted customers often benefit from file sharing, tighter integrations, and more custom automations

- Reduce the need to export data to external spreadsheets and thereby eliminate the inefficiencies that they create

- Create spreadsheet-like queries and export them to Word, Excel, PDF, and Crystal Reports Along with the capability of exporting information to the options below, IMS is able to automatically send reports to a designated shared or internal drives (daily, monthly, yearly or any chosen time frame)

- Maintain a complete security master with all pertinent details

- Integrate with data providers like IDC and Bloomberg and easily import your data

- Aggregate and ‘Data Warehouse’ data from brokers and other service providers

- Warehouse virtually any data element related to your investment activities

- Import account data from multiple sources and aggregate the information for performance measurement and reporting

- Conditionally report variances between datasets

- Manage “external” positions that are held outside of portfolio

- Powerful tool for family offices using GRAT accounting

Integrations

Seamlessly Integrate With Your Other Fin Tech

Connect all of your systems and workflows so everything works seamlessly together. Unlock the value of all your data and optimize operations. VestServe IMS ingrates with a variety of data services, accounting and even your custom internal systems.

- Turnkey full detail integrations with all Pershing Custodians, BNY Mellon, and others

- All transaction and accounting data as well as automatic updates to the Security Master (from the custodial

- Import from either your custodian or a data service (Bloomberg, IDC, and many others)

- Pricing for all security types including exchange rates for currencies

- All corporate action information including dividend and interest payment information

- Benchmark data imports

- Synchronize the IMS investment sub ledger with other corporate accounting systems (including payroll, etc.)

- QuickBooks integration includes automatic updates of investment activity and balances internal systems

- Many other integrations provided from end of day reconciliations to daily imports of transactions

- IMS can export or import data to/from virtually any type of data source (that allows integration)

- Thomson Reuters and IDC security master feeds are available

Hosted Solutions

Deployed On Your Server or Ours

IMS can be deployed on your server or on ours. Today an increasing number of investment managers are choosing to outsource their IT infrastructure so they can focus on making investment decisions, distributing their product, and containing costs.

Vestserve has leveraged its IMS portfolio management and accounting solution with an outsourced suite of services, which we call IMS – LINK. Built on a contemporary architecture IMS – LINK is designed to offer customized outsourced services to asset managers, pension plans, mutual funds and private investment funds. IMS – LINK provides internet connectivity to your users in a secure environment from wherever they connect to the application.

- Full Internet access to Vestserve’ IMS accounting and portfolio management solution with IT infrastructure supported by Vestserve.

- Access IMS - LINK over the Internet day or night without restriction. The system is available 24 hours a day, seven days a week. We supply the data center, hardware, secure communications, and backup facilities etc.in a managed environment

- Grow your business without worrying about the cost of hardware and infrastructure. Vestserve has layered in the technologies required to enable you to focus on doing business and not on running an IT organization. IMS - LINK is supported by a scalable architecture built around Microsoft Windows .NET 4.5 technology and industry standard SQL server database

- Vestserve can develop customized client web portals to provide customizable interaction with the IMS